Home Mortgage Loans

Becoming a homeowner means so much more than buying a house. It’s your home. A place where families come together, memories are made, and futures are planned. Whether you are thinking of buying a home, already own a home, or are looking to buy a second home, Webster First can help guide you through the financing or refinancing process.

Apply NowMortgage programs

Fixed Rate

- As low as 6.680% APR1

- Your rate and payments are fixed for the life of the mortgage

- Terms of 15, 20, 30, or 40 years

- Good option if you plan on staying in your home for longer than 10 years and prefer your payments stay the same

Adjustable Rate4

- As low as 6.357% APR1,4

- Fixed rates and payments to start that are subject to change after a few years

- A variety of terms are available

- Good option if you plan on moving in less than 10 years and prefer a lower payment at the beginning of your mortgage

First Time Home Buyer

- As low as 7.075% APR1

- Your rate and payments are fixed for the life of the mortgage

- A 30 year fixed rate term

- Great option if you are looking to purchase your first home

Refinance

- Available in fixed or adjustable rate terms: Good option if you want to lower your mortgage payment or shorten your payoff time

- Cash-out refinancing available: Great option if you need cash to pay off non-mortgage debt or make home improvements

Current Mortgage Rates

| Type | Rate | APR1 | EMP2 (per $1,000) |

|---|---|---|---|

| Adjustable Rate Mortgages4 | |||

| 5&1 Fixed Variable4 | 6.375% | 6.784% | $6.24 |

| 7&1 Fixed Variable4 | 6.500% | 6.789% | $6.32 |

| 7&3 Fixed Variable4 | 6.625% | 6.736% | $6.40 |

| 10&5 Fixed Variable4 | 6.750% | 6.862% | $6.49 |

| Convertible 1 Yr Adjustable4 | 6.125% | 6.687% | $6.08 |

| 1 Year Adjustable4 | 6.125% | 6.687% | $6.08 |

| 3 Year Adjustable4 | 6.250% | 6.357% | $6.16 |

| 7&1 Variable 40 Year4 | 6.875% | 6.973% | $6.12 |

| Land Loan3,4 | 6.125% | 6.755% | $11.16 |

| Fixed Rate Mortgages | |||

| 15 Year | 6.500% | 6.680% | $8.71 |

| 20 Year | 6.875% | 7.023% | $7.68 |

| 30 Year | 7.000% | 7.115% | $6.65 |

| 40 Year | 7.500% | 7.605% | $6.58 |

| First Time Homebuyers | 7.000% | 7.075% | $6.65 |

2:EMP = Estimated Monthly Payment.

3:Land loans 1-10 years, 25% downpayment

4:ARM loans are variable rate loans, interest rates and payments may increase after consummation. Rates and payments will remain the same for the first 5, 7, or 10 years and then can adjust to a new rate and payment every 1, 3 or 5 years based on a current index, depending on the ARM program you choose. For example, if you select the 5 & 1 Fixed Variable program your rate and principal & interest payment will be fixed for the first 5 years (the 5 in 5& 1), after that the interest rate and payment could change every 1 year for the remainder of the mortgage’s term (the 1 in the 5 & 1).

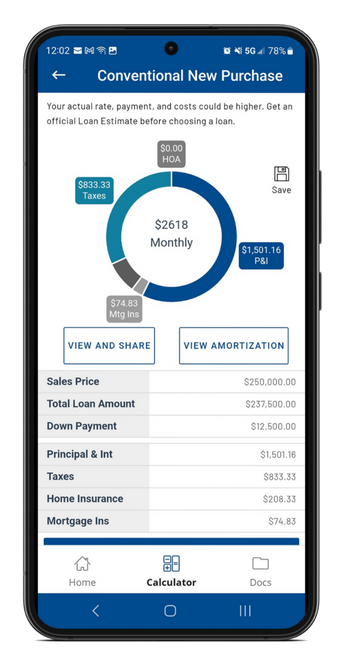

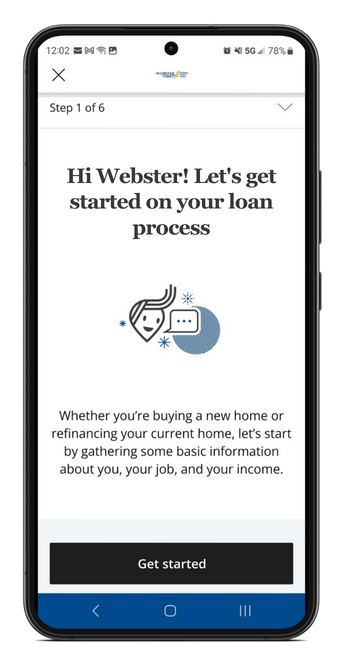

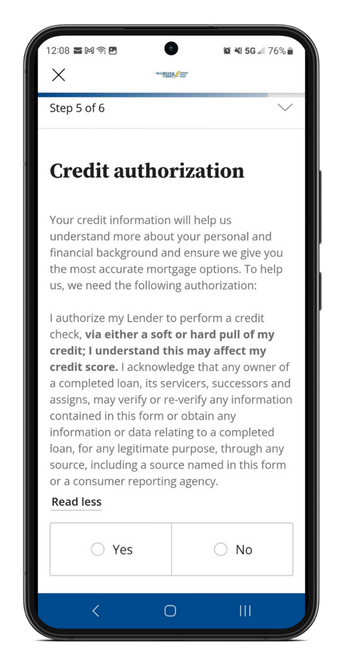

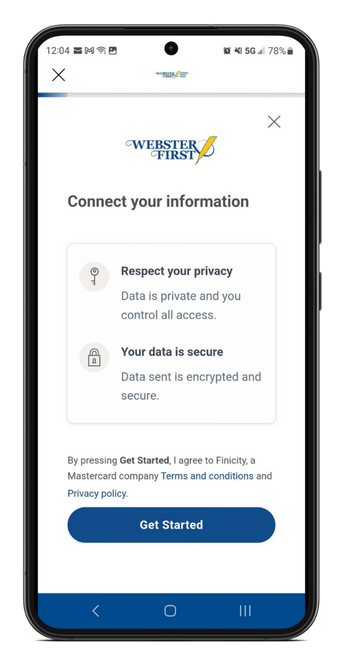

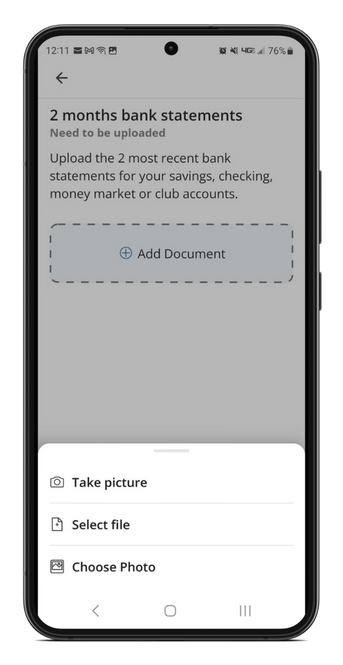

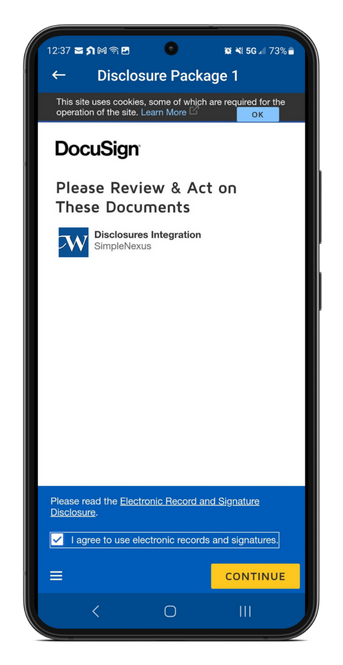

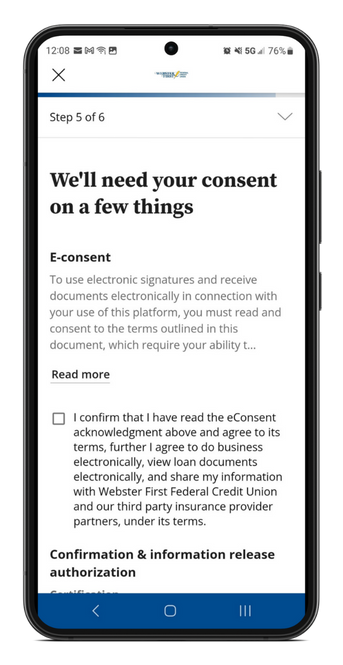

Our mortgage app makes it easy

Looking to buy or refinance a home? Our digital mortgage app makes it easy and convenient.

With one login, you can apply for a loan, complete tasks, securely scan and upload docs, submit payments, check on your loan status, eSign documents, and more. When you start an application online, you’ll find links to download the app to your favorite device.

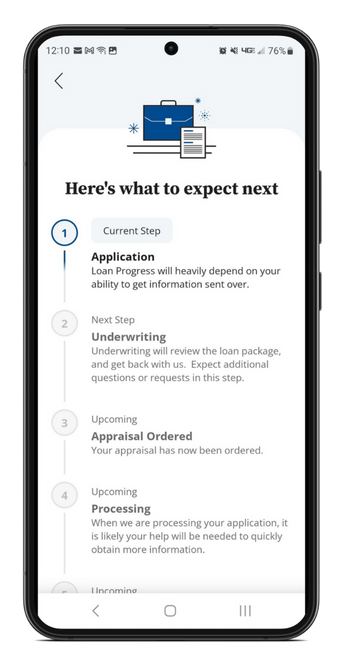

What to expect after you apply

We’ll put it together

Your Mortgage Loan Officer will help you gather the necessary documentation and take care of disclosures.

Underwriting

Our underwriters will pull your credit and make calculations to determine if you are approved for the mortgage. They will also determine your interest rate based on those calculations.

Processing and appraisal

After approval, our team will process your loan and order your appraisal. When your appraisal is returned, the processors can complete their verifications and put together your Closing Disclosure.

Closing

Our in-house closing agent, WebFirst Mortgage, LLC, will walk you through your final paperwork. Congratulations, you're a home owner! It’s time to celebrate.

Award-winning service

How can we help?

Our dedicated loan center team is happy to answer your mortgage-related questions or provide assistance with completing an online mortgage application.

(774) 823-1665

Monday – Wednesday: 8:00 a.m. – 4:30 p.m.

Thursday & Friday: 8:00 a.m. – 5:00 p.m.

Saturday & Sunday: Closed

Learn more about home financing

Home Buying Center

Understanding how to navigate the ins and outs of mortgages can be complicated. That’s why we’ve set up a Home Buying Center to help you become a mortgage pro. Find answers to questions like:

- What are the steps of buying a home?

- What is PMI?

- What is an Escrow Account?

- How do I pay my mortgage?

- And more!

Mortgage Calculators

- Should I refinance?

- How much will my fixed rate mortgage payment be?

- How much will my adjustable rate mortgage payments be?

- How much will my payments be for a balloon mortgage?

- Should I rent or buy?

- Which mortgage is better for me?

- How much will I save by increasing my mortgage payment?

- How much mortgage might I qualify for?

- How much home can I afford?

- Should I consolidate my loans?

Latest articles

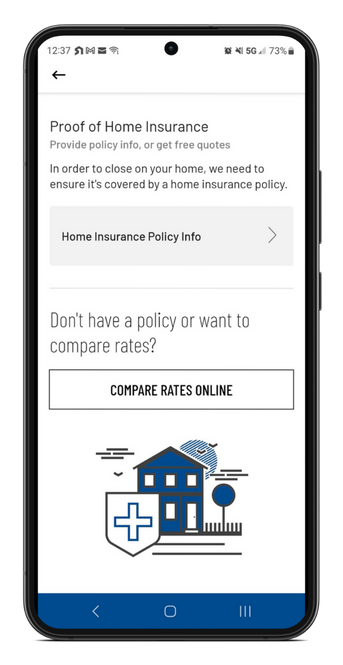

Protect your home for years to come

We’re pleased to offer homeowners insurance through our subsidiary, WebFirst Insurance, LLC. WebFirst Insurance will work with you to determine the right coverage for your needs, and then search their network of carriers to find the right price.

Learn MoreMortgage FAQs

Do you offer mortgage refinancing?

Yes, Webster First offers refinancing of Mortgages, Home Equity Loans, and Home Equity Lines of Credit.

How do I apply?

You can easily apply online.

Can I get pre-approved or pre-qualified?

Webster First only does pre-approvals. Unlike pre-qualifications, a pre-approval requires a full underwrite and credit pull. You are not locked into an interest rate until we receive a property address.

What documents will I need with my application?

While this varies depending on your situation, our team has put together a list of the standard documents for easy reference. Please note that additional documentation may be requested depending on your financial situation.

Do you offer VA or FHA loans?

Not at this time.

What are your application fees?

Application fees are $350 for a mortgage and $600 for a construction loan.

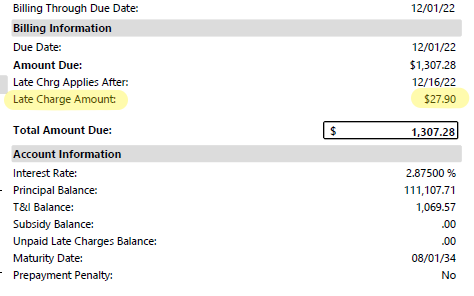

What is your fee for a late mortgage payment?

Late fees will vary based on your total mortgage payment. See your statement billing information. For example:

What is the difference between a fixed rate and an adjustable rate4?

A fixed rate mortgage will have the same interest rate for your entire term. Adjustable rate mortgages4 will change periodically based on the term you choose. Some adjustable rate mortgages are fixed variables meaning they are fixed for a certain amount of years, and adjusted after that period ends. For example: our most popular type of adjustable rate mortgage (ARM) is our 7&1 fixed variable, which means the rate is fixed for the first seven years and then changes once a year for every year after that. See our rates page for more terms.

Do you offer land loans?

Yes. Webster First land loans are only available as adjustable rate4 loans from 1-10 year terms and require a 25% down payment. See our land loan page for more info.

How do Construction Loan disbursements work?

Construction funds are only disbursed for completed items. We will need the following items prior to your first disbursement being released.

- Proof of Insurance/Builders Risk Policy

- Building Permit

- Proposed Plot Plan

Inspections will be ordered by you, the borrower, through the Mortgage Servicing Department, available by:

- Phone – 800-962-4452 ext. 4094

- Email – MortgageServicing@WebsterFirst.com

- Fax – 774-823-1842

Once an Inspection has been requested, please allow a reasonable amount of time for the property to be inspected and the report completed, then returned to Webster First Federal Credit Union for approval. Once the report is approved, allow 1-2 business days for the funds to be disbursed.

Options for how funds can be disbursed:

- Deposited directly into the borrowers Webster First Federal Credit Union account

- Bank check made payable to the borrower(s)

- Bank check made payable to borrower(s) and the builder or contractor

How do I bring in my down payment?

Bring a certified bank check/treasurer’s check on the day of your closing.

What do I do in the event of a borrower’s death?

Contact our Mortgage Servicing department at (800) 962-4452 Ext. 4094 and forward them the death certificate for the mortgage file. If there is a co-signer on the mortgage, they will still be obligated to make payments on the loan. Next steps will vary based on what the deceased had planned to pay off the remaining balance on their mortgage (terms in their will, a trust, life insurance policy, etc.). If there were no plans, the credit union may foreclose on the property.

If there was no co-signer, another person can request to be granted successor in interest which allows them to access certain mortgage information/documentation such as a payoff quote. Based on the circumstances, we will request specific documentation to approve a successor in interest request.

I received a check for an insurance claim on my house with Webster First’s name on it. What do I do now?

If you have a lien on your house and an insurance company pays you for damages (such as a fire, tree falling on it, etc.) the check will be made out to both you and the lien holder (Webster First). Our Mortgage Servicing department will be able to help you disburse the funds from the check, but portions of those funds may be held and released to you later. Contact them at (800) 962-4452 Ext. 4094.