General

What is Webster First’s routing number?

Webster First’s routing number is 211386597.

What is my member number? Is it different from my account number?

Your member number is the number all your related accounts are bundled under. Many Webster First members have a checking, savings, and investment account all associated with the same member number. Your member number is listed on the top of your printed statements or eStatements. (Please note, your statement may list “Account Number” in the top left, as shown below.)

Under your member number, each individual account will have its own account or MICR number. In most cases, each account number contains your member number. Your account number can be obtained from your checks, online banking, or the mobile app.

To find an account number in online banking, click on the desired account, and then click “Account Details:”

To find an account number in our app, tap on the desired account, then tap “Details:”

To find an account number using your checks, follow the diagram below:

How do I know if I am eligible for membership?

You are eligible to join Webster First if you live, work, worship, or attend school in Essex, Middlesex, Suffolk, or Worcester County of Massachusetts.

Businesses and other legal entities located in Worcester, Essex, Middlesex, or Suffolk Counties, Massachusetts are also eligible to join.

Additionally, you are eligible if you are a current Webster First employee, are a volunteer in the community, or are the spouse of someone who died while within the field of membership.

Members of the immediate family or household, and organizations of anyone meeting these qualifications are also eligible to join.

What is the difference between a bank and a credit union?

Banks are for-profit financial corporations that conduct business to maximize the price of their stock and profit for their stockholders. Credit unions are not-for-profit financial cooperatives that conduct business for the mutual benefit and general welfare of their member owners.

What are Webster First’s fees?

What are the Terms & Conditions on my account?

What is Webster First's Privacy Policy?

I need to update my street or email address, how can I do that?

If you use online banking or our app, you can simply update them there. You’ll need to update your address separately within Bill Pay as well. Not an online banking user? Call us at (800) 962-4452 or stop by your local branch.

Where can I learn more about career opportunities and jobs with Webster First?

Interested in working at Webster First? Visit our careers page to view available positions and apply for jobs online today.

What holidays is Webster First closed on?

As a federal credit union, Webster First observes all federal holidays. Additionally, we typically have reduced hours on Thanksgiving Eve, Christmas Eve, and New Year’s Eve. You can view our holiday schedule and closings here.

How will I know if Webster First is closed due to snow or inclement weather?

Sometimes a snow day is inevitable in New England. If our branches are closed due to snowy conditions or other inclement weather, we’ll put a notice on websterfirst.com.

I received a letter requesting a current copy of my insurance. Why did I receive this letter and what do I do next?

As part of your loan obligation, you are required to maintain physical damage insurance for the full term of your loan. Please visit MyInsuranceInfo.com to enter and verify your insurance information so that we may update your records.

How do I get my free annual credit report?

You can get a free report from each of the three nationwide consumer reporting companies every 12 months as a result of an amendment to the Fair Credit Reporting Act. Visit annualcreditreport.com or call (877) 322-8228 to obtain a copy. Please note that annualcreditreport.com is the ONLY authorized online source for you to receive a free credit report under federal law.

Annualcreditreport.com will NEVER send you an email solicitation for your free annual credit report or use pop-up ads. If you paid for what you thought was your free annual credit report, go to www.ftc.gov and click “File a Complaint” on the menu.

Accounts, cards, checks, and direct deposit

What do I do if my ATM/Debit Card is lost or stolen?

If your ATM/Debit Card has been lost or stolen during business hours, please call us at (800) 962-4452 for immediate assistance. If your card has been lost or stolen after hours, please call (800) 528-2273 for assistance.

How do I re-order checks?

You can re-order checks at a branch, using the mail order form provided in your current box of checks, or online. When you are ready to re-order your checks online, please make sure to have your check re-order slip ready. To place an order, log in to Harland Clarke’s check reordering website by clicking here. You may log in using your Order Identification Number and Check Number found on your check re-order form.

What do the numbers on my checks mean? How can I find my routing number and/or my account number?

Your checks feature Webster First’s routing number, your account number, and the check number. Please refer to the diagram below for reference. Please note that the diagram is for reference only, and the length of your actual account number may differ from what’s shown.

How can I place a stop payment on a check?

You can place a stop payment on a check by completing the form in online banking or our mobile app, contacting our call center, visiting a branch, or via telephone banking. Please note that there is a fee assessed for each stop payment order. Refer to our fee schedule for more information.

Does Webster First offer a free senior checking account?

We do not currently offer a free checking account exclusive to seniors, but our First Advantage Checking account offers no monthly maintenance fees. ($5 minimum balance to open.)

Does Webster First offer a free student checking account?

Our Jump Start Checking is specifically designed for young adults ages 15 – 22 and has $0 monthly maintenance fees. The account will automatically upgrade to our First Advantage Checking once you reach 23 years of age. ($5 minimum opening balance.)

Does Webster First offer overdraft protection?

Yes, we offer three different overdraft options – overdraft protection, overdraft privilege, and overdraft protection lines of credit. Read more about all overdraft options here.

Does Webster First offer a vacation club or Christmas club account?

We offer an All Purpose Club account, which is great for saving for any type of goal. Whether it’s a vacation, Christmas, wedding, etc.

Does Webster First offer credit cards?

We do not offer credit cards at this time.

Why is a savings account called a “Primary Share”?

Credit unions are not-for-profit, so when you become a member of Webster First, you also become part shareholder. Your deposits earn dividends because they are shares – as opposed to interest which is what your deposits would earn at a bank.

Can I use my Webster First Debit Card in a mobile wallet?

Yes! You can add your Webster First Debit Card to any mobile wallet.

How do I dispute a charge on my debit card?

You can dispute a charge or report a lost/stolen debit card by calling (800) 962-4452 during business hours. To report a lost or stolen card after hours, call (800) 528-2273.

How do I let someone know I’ll be traveling and using my debit card out of state?

Call our Member Service Center at (800) 962-4452. They will be able to add a note to your account.

Can I apply for an IRA online?

No. You must apply for an IRA at a branch.

Banking on the go

How can I check my balance without visiting a branch?

Online banking, mobile banking, and telephone banking are all convenient ways to check your balances anytime, anywhere.

Can I deposit checks from home or on the go?

Yes! Remote deposit is available in our mobile app and online banking. Please note, you will need to download our DeposZip desktop application onto your Windows computer in order to make remote check deposits from online banking.

I don’t have a smartphone. How can I access my accounts on the go?

If your phone offers text messaging, you can use text message banking. A guide is available on our Mobile Banking page.

If you don’t have text messaging enabled, you can use telephone banking from any touchtone phone.

Consumer loans

What is a consumer loan?

At Webster First, consumer loans include auto loans, motorcycle loans, recreational vehicle loans (RV, boat, camper, jet ski, quad, snowmobiles), personal loans, credit builder loans, and student lines of credit.

What are your application fees?

Webster First does not charge application fees on consumer loans.

Do you offer refinancing on loans from other institutions?

Yes! We offer refinancing on all types of consumer loans you have with another lender.

What documents do I need to bring in when applying for a loan?

When applying for a loan, you will need to provide proof of identity, such as a driver’s license. When finalizing your loan, your loan officer will provide you with a list of any other documents you may need to provide in order to have the loan disbursed.

Do I need to be a member to get a loan?

Yes, you do need to be a member in order to obtain a loan from Webster First, however, you don’t need to be a member in order to apply. We can sign you up for membership when you finalize your loan.

My credit may not be very good. What options do I have when applying for a loan?

If you suspect your credit may not be very good, you can try to improve your score by paying down debts such as credit card balances, avoiding making unnecessary credit report inquiries which may drive down your score, or by completing a Webster First Credit Builder Loan17.

If you don’t qualify for a loan yourself, you can try re-applying with a co-signer. A co-signer is not a guarantee of approval, but it may help you get approved.

17: Proceeds will be put into a certificate for the same term as the loan. The full original amount of the loan will be held until the loan is paid off. No withdrawals can be made from the certificates (even with penalty) unless the loan is paid in full.

I am not currently employed, but I do have some income coming in. Can I get a loan?

All claimed income will be considered when you apply for a loan. This income may include social security, pensions, VA benefits, etc.

How old of a vehicle will you finance?

Whether or not we finance a vehicle depends upon the value of the vehicle. Since this will be different for each vehicle, we recommend you call us at (800) 962-4452 or visit a branch for a more personalized answer.

Do I need to pick out a car first before I can apply for a loan?

You do not need to have a particular vehicle picked out in order to apply for pre-approval.

Do I need a down payment for an auto loan?

Typically, we can finance 100%, however this is reviewed at the borrower/application level.

What will my rate be?

Depending upon the type of loan you select, your exact rate may be determined by your credit score and collateral. To view our current rates, click here. For more information, visit a branch or call us at (800) 962-4452.

Why can't you just tell me the rate on the loan now, rather than after I apply?

Since your exact rate will be determined by your credit score and collateral, we cannot determine the rate without pulling your credit report. Your credit report cannot be pulled unless you apply for a loan with us and provide us with permission to look at this information.

What will my payment be?

Your monthly payment amount will depend upon the amount of your loan, the exact interest rate you qualify for, and the term length of the loan.

How long does it take to get my coupon book after I close on my loan?

You will receive your coupon book within 14 business days.

What if I lose my loan payment coupons? How can I get more?

Yes, contact us (800) 962-4452 and we’d be happy to assist you.

What time of the month are payments due? Can I pick a time?

Generally, your first payment will be due 30 days after your loan is disbursed. Your payments will always be due on the same day of each month. If you would like to have your payments due on a particular day of the month, please inform your loan originator so he/she can attempt to schedule that for you. We cannot guarantee that your payment due date will be exactly what you request, but we will work with you to try and make that happen.

Can I make loan payments online?

Yes, you can make loan payments online.

How can I make a loan payment?

You can make payments to your consumer loan by dropping off the funds in a branch, mailing in a check, making a transfer in online/mobile banking, or using the Payment Portal.*

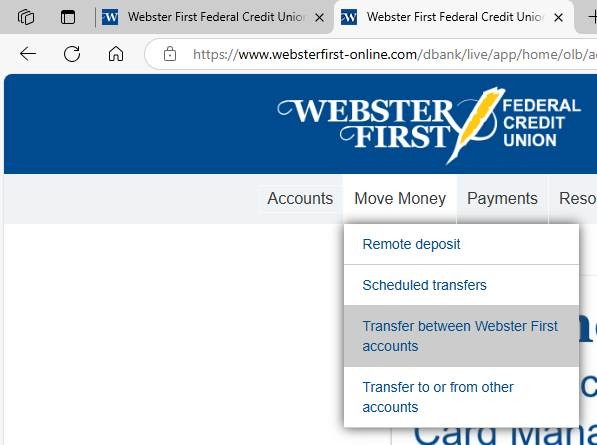

Only the primary account holder can transfer funds to the loan online. On your home screen in online/mobile banking, click Move Money, then “(Transfer) Between my Webster First Accounts.”

If mailing a check, include your account number in the memo line. Mail to:

Webster First Federal Credit Union

PO Box 70505

Worcester, MA 01607

*Payment Portal can be used by members who do not elect to sign up for an online banking account. We recommend you use online/mobile banking to make your payment if you have an account set up.

How do I make a payment from an external account?

If you would like to transfer a payment from an account at another financial institution, there are a few ways you can do it. In your online banking toolbar at the top of the screen, click on Payments > Pay my loan from another account. In your mobile banking toolbar at the bottom of the screen, click on Payments > Pay Loan from another account. Use the Payment Portal only if you do not have an online banking account.

You can also schedule a one-time ACH transfer by contacting our Call Center at (800) 962-4452. They will have you sign a ACH Authorization form.

I have a Webster First loan, but don’t have online banking. Can I make a payment online?

Yes! If you would like online access, you can enroll in online banking. We recommend our online banking as the best method to make payments. If you don’t want online access, you can make one-time payments using our payment portal.

How do I set up recurring payments?

You can set up a recurring payment a few different ways. To set up a recurring payment from a WFFCU account, use your online banking account and click “Move Money” > “Transfer Between Webster First Accounts.” Type in your desired date and amount to be transferred then check the box that says “Repeat Transfer.”

To set up a recurring payment from an outside account, you can use either online banking (recommended) or Payment Portal . In online banking, click “Transfer” > “To/From Outside Accounts.” Then choose your accounts and select the frequency for the transfer. In Payment Portal, sign in to make your payment as you normally would and select the payment frequency there.

The last way is by contacting our Call Center at (800) 962-4452, and signing an ACH Authorization form with your account information. You can choose the amount and which day of the month you would like the payment to be pulled.

Can someone else come into a branch and make a payment for me?

Yes, someone else can make a payment on your behalf. They can pay with cash, a check, or as a transfer out of their Webster First account.

Are there penalties if I want to pay extra or pay off my loan early?

There are no pre-payment penalties for any Webster First consumer loans. You can pay extra or pay off your loan early with no penalties.

How do I pay off my loan?

Contact our member service center at (800) 962-4452 for a payoff quote. Let them know the date you would like to pay off, as daily interest earned can change the amount. Funds can then be sent via check, wire, or internal transfer.

How far can I pay my automobile, personal, motorcycle, RV, share or heavy equipment loan in advance?

Loan payments are scheduled monthly, you may make extra regular payments, but the farthest you can be paid ahead is 3 payments. Any payment or payment amounts that fulfill a regular payment due amount beyond 3 payments will not advance the due date.

How are my consumer loan payments applied?

Payments are applied in the following manner: Accrued Interest, Fees or late charges and principal. If you pay more than your regular payment, the extra amount will be paid toward principal and may advance your due date up to the paid ahead limit of 3 periods.

How do you report late payments?

You have a grace period from your due date to make a payment before a late fee is assessed. Refer to your note to see what that period is for you. We report the loan status to the credit bureaus on the 5th of each month.

What do I do in the event of a borrower’s death?

If a borrower on a consumer loan has passed away, contact the consumer loan department at (800) 962-4452 Ext 4098 to let them know and forward them the death certificate for the file. If there is a co-signer on the loan, they will still be obligated to make the payments. If there is no co-signer, next steps will vary based on what the deceased had planned to pay off the remaining balance on the loan (death clause, terms in their will, a trust, life insurance policy, etc.).

I received a check for an insurance claim on my car with Webster First’s name on it. What do I do now?

If you have a lien on your car and an insurance company pays you for damages (such as a car accident, tree falling on it, etc.) the check will be made out to both you and the lien holder (WFFCU). Please bring your check into any of our branches along with your completed work order form and a loan officer will be able to endorse the back of the check for you.

For additional info on insurance claims, see “How to File an Insurance Claim on Your Car.”

How can I make a principal only payment?

Principal only payments can be made to consumer loans in online banking or our mobile app. When logged in, choose “Move Money” > “Transfer between Webster First accounts”