How your mortgage payments are applied

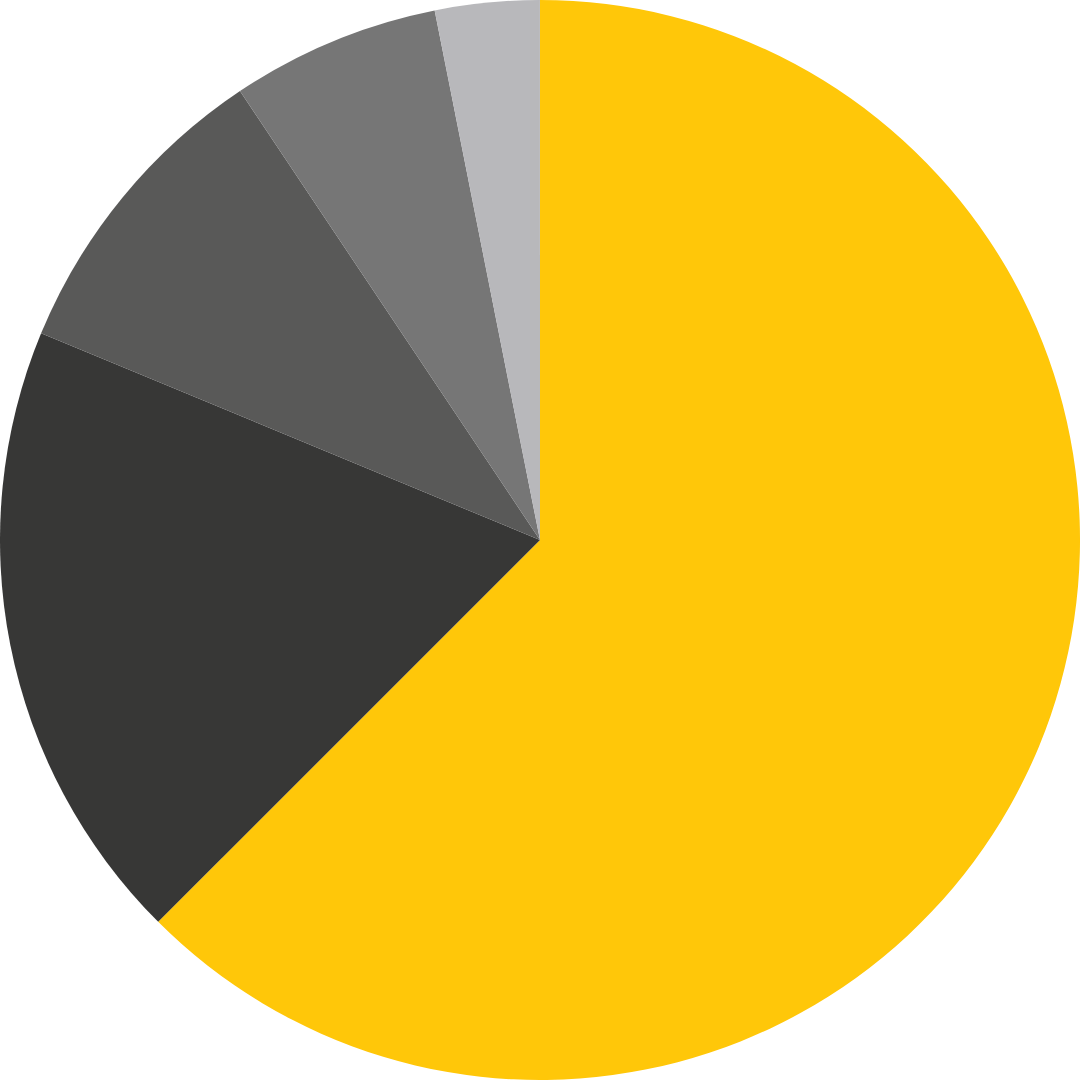

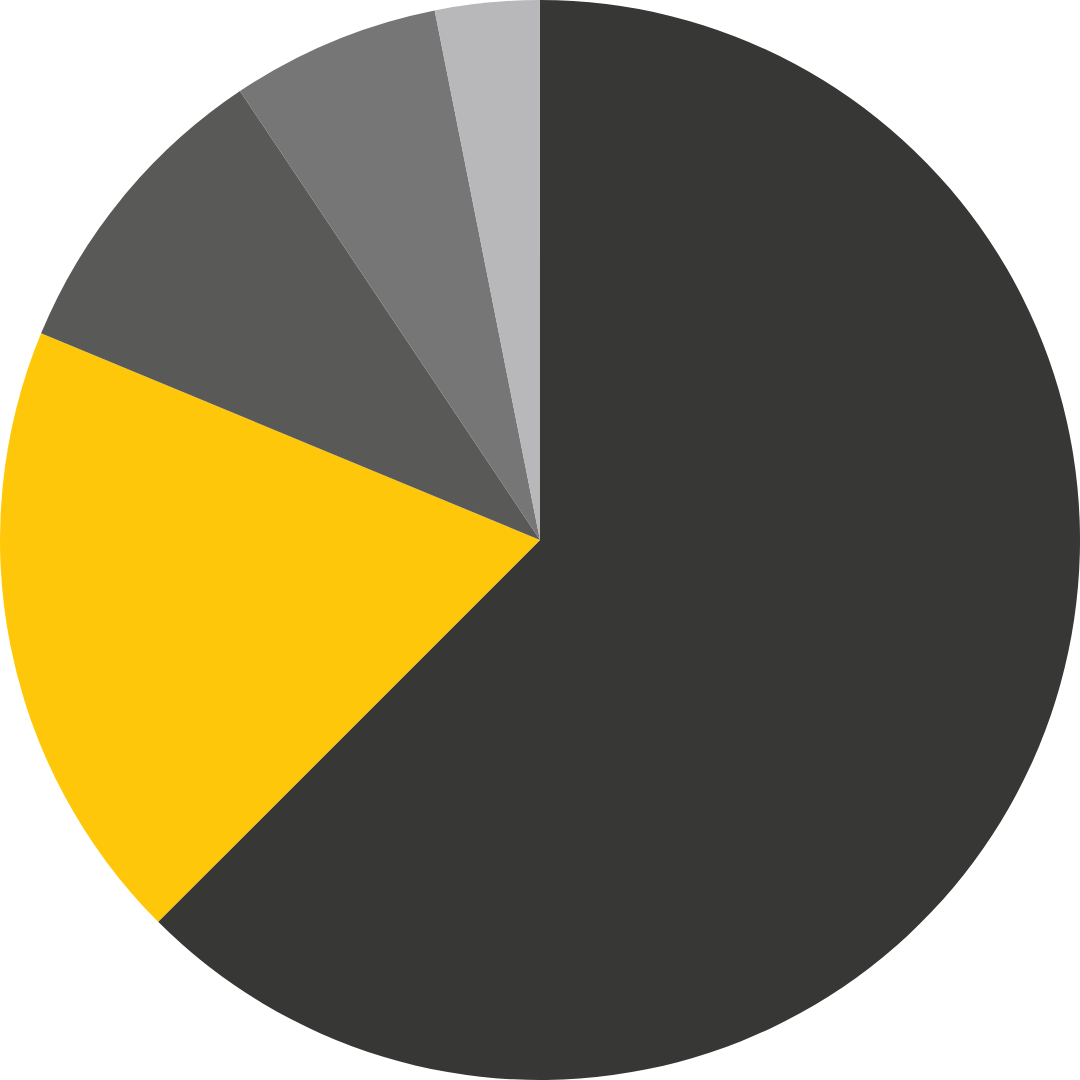

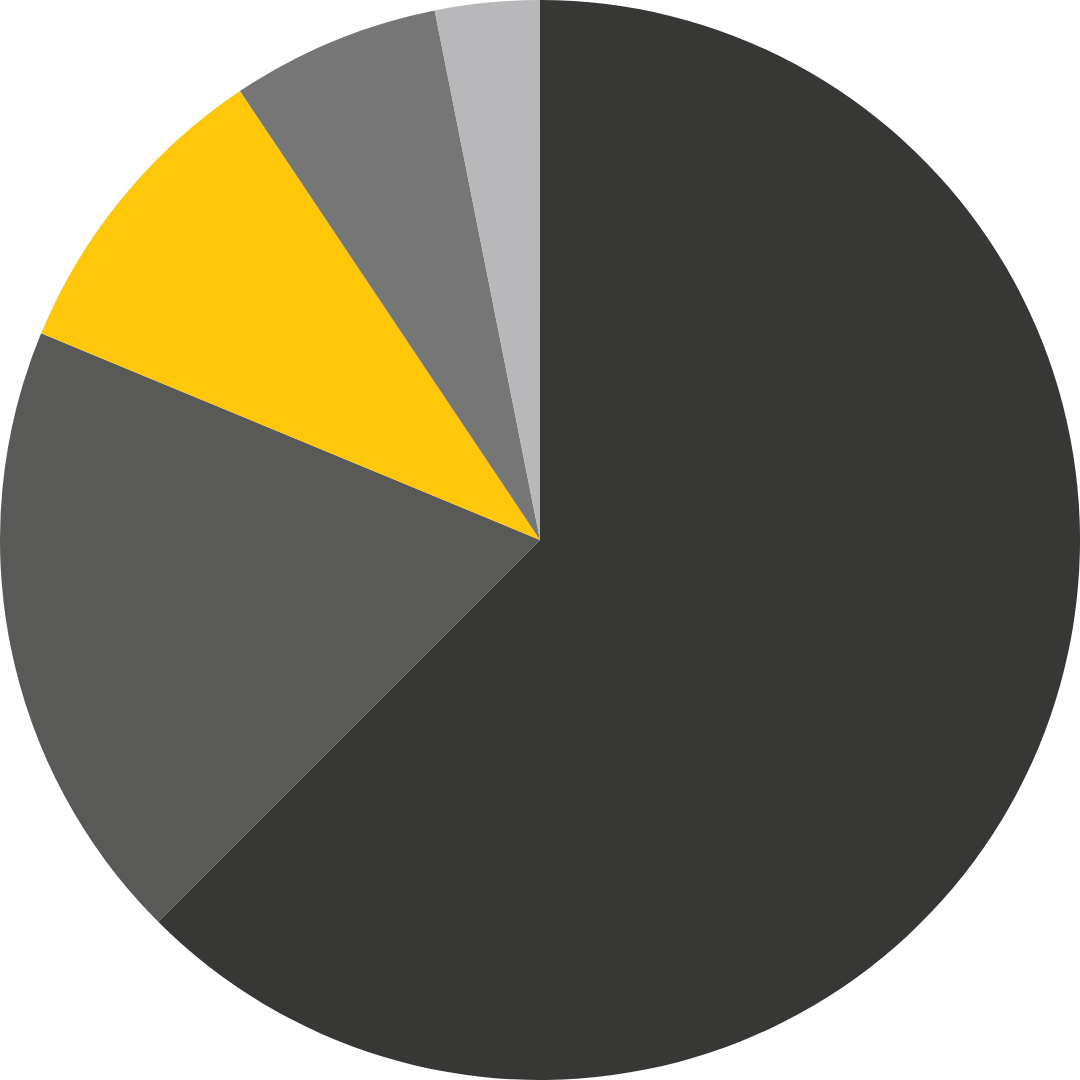

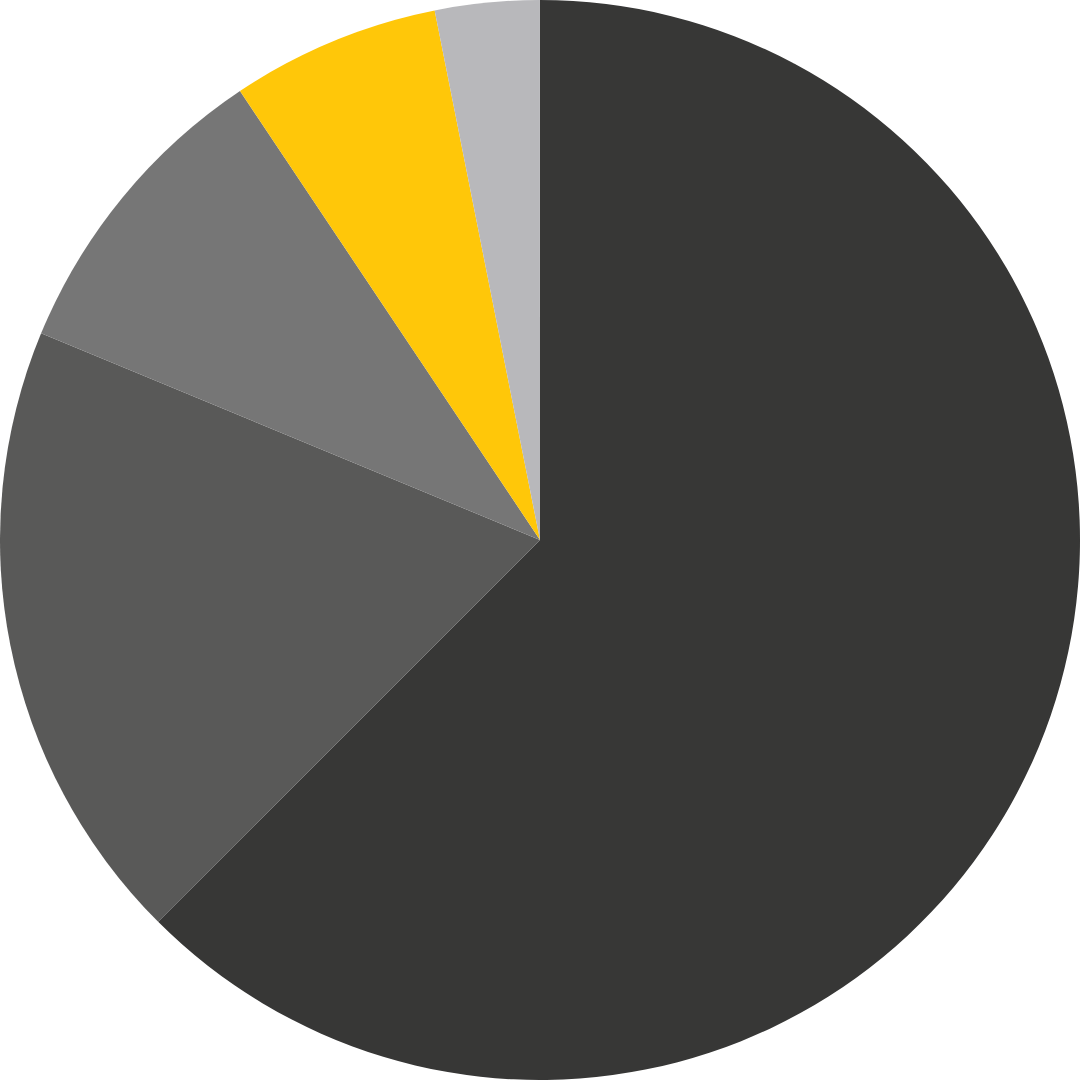

Your mortgage payment is likely the costliest bill you pay, but do you understand how that payment is applied? Your total mortgage payment can be made up of 3-5 different payments depending on your situation. Here’s what they are:

How do I make a payment?

Mail a check to:

Webster First Federal Credit Union

PO Box 70505

Worcester, MA 01607

FAQs

How do I make a payment from an external account?

If you would like to transfer a payment from an account at another financial institution, there are a few ways you can do it. In your online banking toolbar at the top of the screen, click on Pay > Pay my Loan from an Outside Account. In your mobile banking toolbar at the bottom of the screen, click on More > Pay Loan from Outside Account.

You can also schedule a one-time ACH transfer by contacting our call center at (800) 962-4452. They will have you sign a ACH Authorization form.

How can I set up recurring payments?

There are a few ways to do this. One way is by signing a Pre-Auth form with your loan officer or mortgage servicer. If you set up transfers this way and your payment amount changes, it will be updated to satisfy your payment. We recommend this option for recurring payments coming from a WFFCU account.

Another way to set up recurring payments is through your online banking. Click “Additional Services” in the top tool bar, then “Mortgage Payments and History.” This will take you to Estatus Connect where you can set up recurring payments. Estatus is recommended if you are setting up transfers from an external account. If you choose to do it this way, you will need to manually update your payment amount when it changes.*

The third option you have is to sign a recurring ACH form with our EFT department. This option will also update your payment amount and can be used for external account transfers.

*Payment amounts will typically change on your August 1 due date each year for residential loans that have escrow accounts or at your rate change date for ARM mortgages.

How do I make a principal-only payment?

Making additional principal-only payments can shorten the life of your loan. You can make a principal-only payment in branch or online, but always let the Mortgage Servicing department know at (800) 962-4452 Ext 4094 so that they can apply the payment as such. Otherwise the system may automatically apply it as a regular payment and move your due date forward. Your mortgage payment must be current to make a principal-only payment.

If you plan to make a large principal payment of more than $5000, you can request to have your payments re-amortized. This will keep your maturity date the same and lower your monthly payment.

What is PMI?

Visit our What is PMI? page for an in-depth explanation.

What is an Escrow Account?

Visit our What is an Escrow Account? page for an in-depth explanation.

How do you report late payments?

You have a 15-day grace period from your due date to make a payment before a late fee is assessed. If your payment is due on the 1st of the month, a late fee will be assessed on the 16th. We do not report late payments to the credit bureaus until they become 30 days late.

How can I see my mortgage payment history?

You can see your mortgage payment history on your monthly statement. If you would like to see your history online, you can log into your online banking account, click “Additional Services” in the top tool bar, then “Mortgage Payments and History.” This will take you to Estatus Connect where you can see a more detailed snapshot of your mortgage history.

How do I pay off my mortgage?

Contact the Mortgage Servicing department at (800) 962-4452 Ext 4094 to receive a quote. Your attorney can also contact mortgage servicing with a signed borrower’s authorization form to obtain the quote on your behalf. You will need to know the specific day you will be paying off your mortgage, as interest will make the payoff amount change day-to-day. Payments can then be applied by mailing in a check, transferring the balance from another account, wiring the funds, or dropping off the funds in branch.

What is per diem?

When you see a per diem amount included in your payoff quote, that amount is showing the interest your mortgage accrues in one day. The reason it is included in your quote is for you to adjust the payoff amount in case it is received later than the payoff date. For example: the mail can be unpredictable, so if you are mailing in a check it is safe to include a few extra days of the per diem amount with the payment. If your check arrives short it cannot be applied, but if it arrives with extra, those funds will be returned to you.