Securely access your accounts anytime with online banking

Put your finances at your fingertips with online banking, offering access to your accounts twenty-four hours a day, seven days a week.

Sign Up Secure LoginOnline banking at a glance

Sign up to get started

We’ve made it easy to enroll in online banking. You can sign up from your desktop, phone, or using our mobile app. Check out our handy guide to get started.

Login security you can trust

When you first sign up, you’ll be asked to enroll a phone number or authenticator for Multifactor Authentication. This allows us to confirm your identity in two separate ways, adding an extra layer of security.

Check your balances

Online banking gives you all your account balances right on the home screen. Click into each account to view account history, transactions, and pull up check images.

Easily create a budget

Our Money Management tool turns you into a financial ninja. Get a total financial picture and view all of your accounts – both at Webster First and elsewhere – at a glance. Set budgets, track your spending, and compare debt payoff strategies.

Move money and make payments

Make loan payments, pay bills, and get alerts about upcoming bill due dates. Make transfers between your Webster First accounts and accounts at other institutions.

Go paperless for added convenience

eStatements are the paperless alternative to traditional statements. Sign up for eStatements and you’ll get your monthly statements faster, right from online banking. Plus, eStatements are more secure than statements sent through the mail.

Budgeting made easy

Stay on top of your finances with industry leading personal financial management (PFM) software, Money Management.

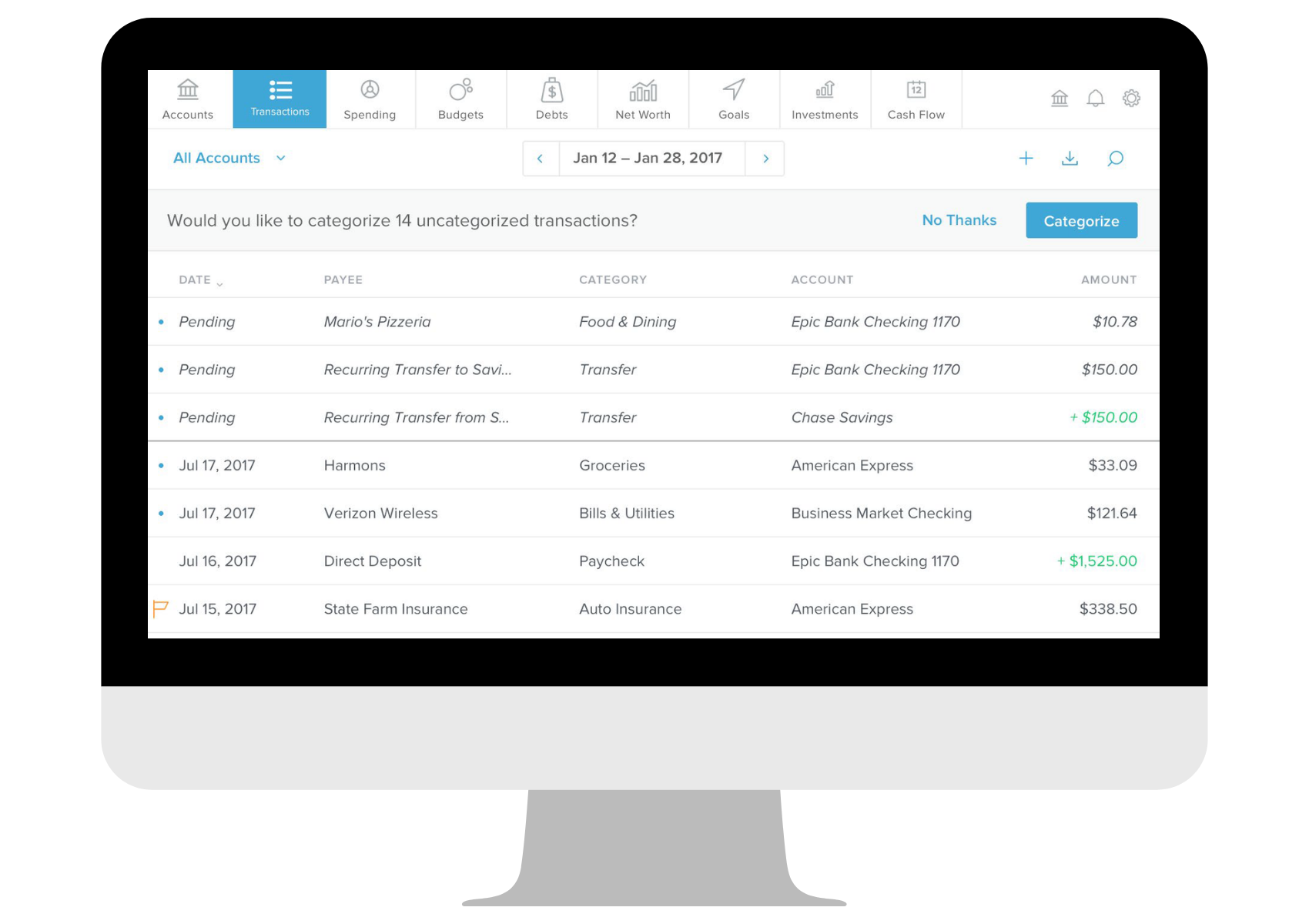

View all of your accounts

- Your Webster First accounts are pre-loaded

- Connect outside accounts with a simple authentication

- Keep track of balances, transactions, interest rates, and more

- Search by keyword or amount, account, or date to quickly find specific entries

- Tax deductible transactions can be marked throughout the year and filtered for easy access come tax time

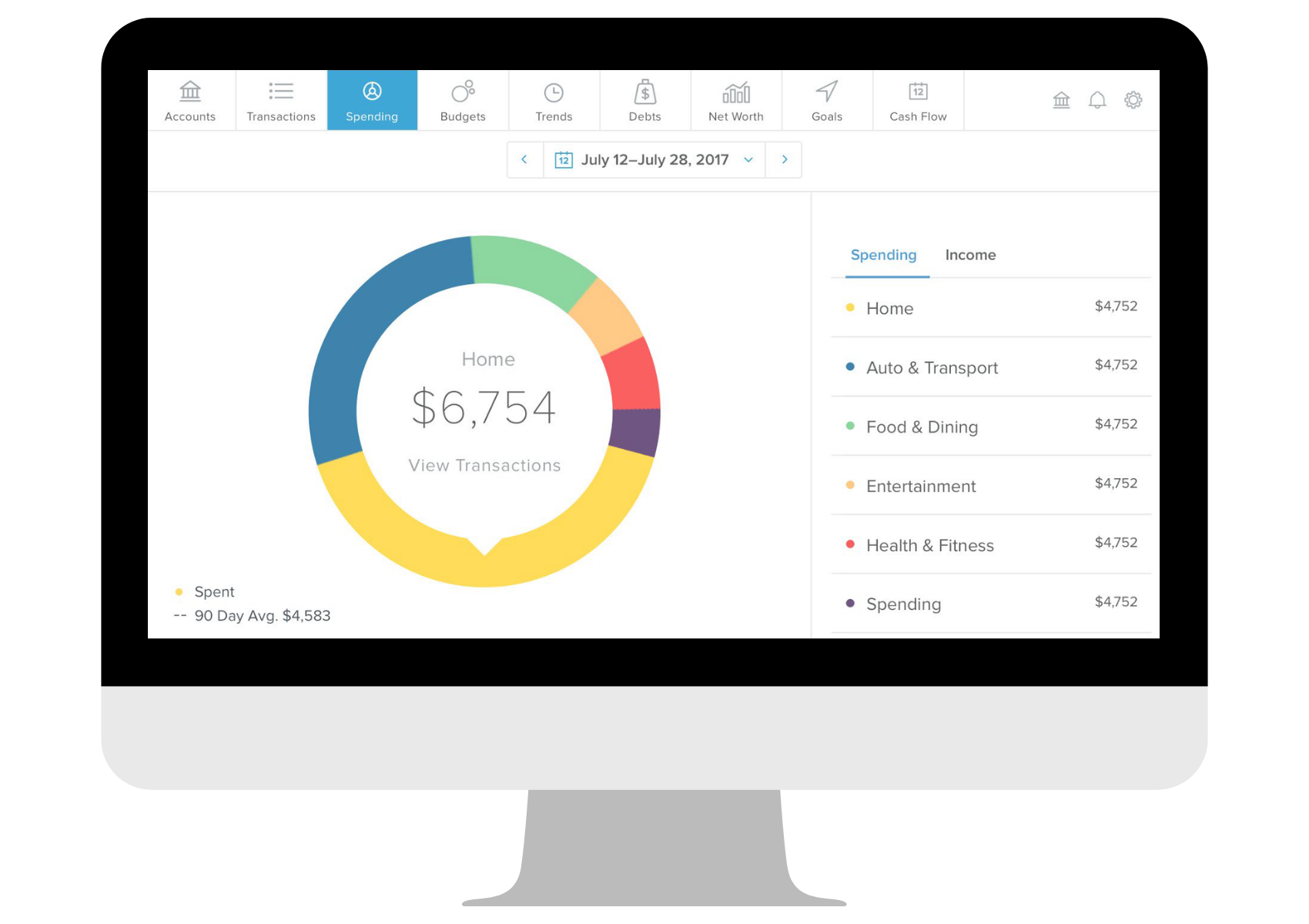

Keep track of spending and set budgets

- See spending broken down into categories to quickly see where your money is going

- Easily see how close you are sticking to your budget

- Use automatic categories provided by Money Management or create your own custom categories

View your progress over time

- Trends provide a view of spending over time divided into categories

- See how your spending fluctuates throughout the year and set more realistic budgets and goals for the future

- Debts tool forecasts debt payoffs and compares strategies, providing a roadmap to get out of debt

Making payments and transfers is easy

Bill pay

Skip the stamp and pay your bills easily online. Bill pay keeps you on top of your finances with email alerts for new bills, upcoming due dates, and payments.

For personal checking accounts:

- No fee to use

- Your Bill Pay account will be attached to your personal checking account, with one Bill Pay account allowed per each member number

For business checking accounts:

- No fee for First Advantage for Business Accounts

- For Elite Business Checking Accounts: 15 free transactions per month, $0.60 per item thereafter

- Your Bill Pay account will be attached to your business checking account, with one Bill Pay account allowed per each member number

Funds transfer

Moving money between accounts is easy with Funds Transfer.

- Move money between your Webster First accounts and accounts at other institutions.

- Make one-time transfers

- Set automatic recurring transfers

There is a 60 day waiting period to use Funds Transfer for new Webster First Federal Credit Union members. Current members must be in good standing with Webster First to use Funds Transfer. Members must have a signed Online Banking application to use Funds Transfer. Transferring funds may be subject to fees. Please review our fee schedule.

Personal funds transfer limits:

- $2,000.00 combined inbound and outbound per day

- $5,000.00 rolling 30 day limit

Commercial funds transfer limits:

- $15,000.00 combined inbound and outbound per day

- $25,000.00 rolling 30 day limit

FAQs

How do I sign up for online banking?

Signing up is quick and easy. We’ve created a handy guide to help you sign up and enroll in multifactor authentication.

What is multifactor authentication?

Multifactor Authentication (MFA) means two or more different types, or factors, of authentication must be passed before a user is allowed to access an account online. By using two different factors of authentication, we get a higher assurance that the user accessing the account is the rightful user.

MFA is commonly used to protect transactions at ATMs, where your card is something you have, and your PIN code is something you know. Similarly, with online banking, your phone is something you have, and your password is something you know. By requiring your password AND sending a One-Time Passcode to your previously enrolled device, we create a higher level of protection for your account.

What’s a one-time passcode?

A One-Time Passcode is different from your password. Your password is something you create, and you’ll use it each time you log in. A One-Time Passcode is automatically generated, and only works for the specific individual login attempt being made. Each time you attempt to log in to your account on a new or unrecognized device, a different and unique One-Time Passcode will be generated and sent to you for confirmation of your identity.

What's an authenticator?

An authenticator is an app you can download to your iOS or Android device to provide an extra layer of security at sign in, most often in the form of a generated code.

How do I get an authenticator?

You can download and install one from the App Store or Google Play.

Supported Authenticator Apps: Google Authenticator or Microsoft Authenticator.

Can I use remote check deposit?

Yes. Although we recommend our mobile app for the most convenient way to remote deposit checks, you can install our DeposZip app to deposit checks from your Windows computer using online banking.

How do I sign up for eStatements?

Signing up for eStatements is quick and easy and can be completed at a branch or by clicking on the “eStatements” link in Online Banking. Once you sign up, you’ll no longer receive printed statements.

Can I deposit checks with online banking?

Our mobile app is the easiest way to make remote check deposits. If you have no mobile app access or are planning to deposit a batch of checks, download our DeposZip application to your Windows Desktop to deposit checks right from online banking.

You must be 18 years of age or older in order to apply for access to Online Banking.