Construction Loans

You’re building so much more than a house. You’re building your home. The place where family comes together, memories are made, and futures are planned. Webster First will help you build with a construction to permanent loan. Apply today for your customized construction loan rate.

Apply NowConstruction loan program details

- Rates as low as 6.357% APR1

- Enjoy an extended 12 months to build your dream home

- No pre-payment penalties

- Shrink your term by making extra payments to your principal balance

- Your loan converts to a regular fixed rate or adjustable rate mortgage after construction is complete

- Save money with only one closing

Home lending rates

| Type | Rate | APR1 | EMP2 (per $1,000) |

|---|---|---|---|

| Adjustable Rate Mortgages4 | |||

| 5&1 Fixed Variable4 | 6.375% | 6.784% | $6.24 |

| 7&1 Fixed Variable4 | 6.500% | 6.789% | $6.32 |

| 7&3 Fixed Variable4 | 6.625% | 6.736% | $6.40 |

| 10&5 Fixed Variable4 | 6.750% | 6.862% | $6.49 |

| Convertible 1 Yr Adjustable4 | 6.125% | 6.687% | $6.08 |

| 1 Year Adjustable4 | 6.125% | 6.687% | $6.08 |

| 3 Year Adjustable4 | 6.250% | 6.357% | $6.16 |

| 7&1 Variable 40 Year4 | 6.875% | 6.973% | $6.12 |

| Land Loan3,4 | 6.125% | 6.755% | $11.16 |

| Fixed Rate Mortgages | |||

| 15 Year | 6.500% | 6.680% | $8.71 |

| 20 Year | 6.875% | 7.023% | $7.68 |

| 30 Year | 7.000% | 7.115% | $6.65 |

| 40 Year | 7.500% | 7.605% | $6.58 |

| First Time Homebuyers | 7.000% | 7.075% | $6.65 |

2:EMP = Estimated Monthly Payment.

3:Land loans 1-10 years, 25% downpayment

4:ARM loans are variable rate loans, interest rates and payments may increase after consummation. Rates and payments will remain the same for the first 5, 7, or 10 years and then can adjust to a new rate and payment every 1, 3 or 5 years based on a current index, depending on the ARM program you choose. For example, if you select the 5 & 1 Fixed Variable program your rate and principal & interest payment will be fixed for the first 5 years (the 5 in 5& 1), after that the interest rate and payment could change every 1 year for the remainder of the mortgage’s term (the 1 in the 5 & 1).

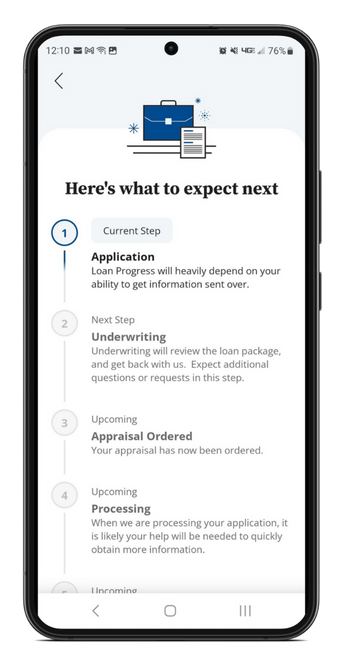

What to expect after you apply

We'll put it together

Your Mortgage Loan Officer will help you gather the necessary documentation and take care of disclosures.

Underwriting

Our underwriters will pull your credit and make calculations to determine if you are approved for the mortgage. They will also determine your interest rate based on those calculations.

Processing and appraisal

After approval, our team will process your loan and order your appraisal. When your appraisal is returned, the processors can complete their verifications and put together your Closing Disclosure.

Closing

Our in-house closing agent, WebFirst Mortgage, LLC, will walk you through your final paperwork. Congratulations, you're ready to build!

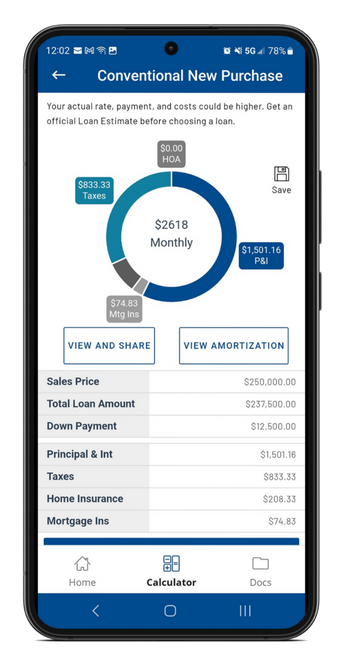

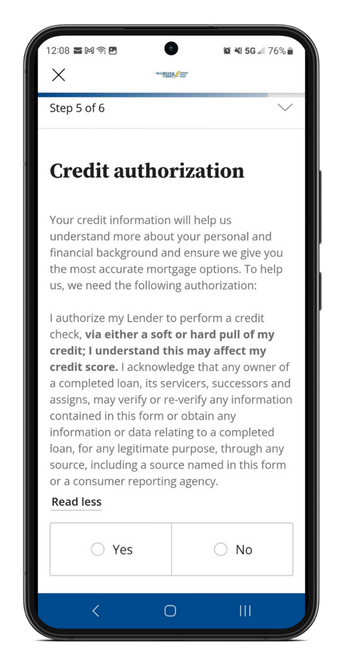

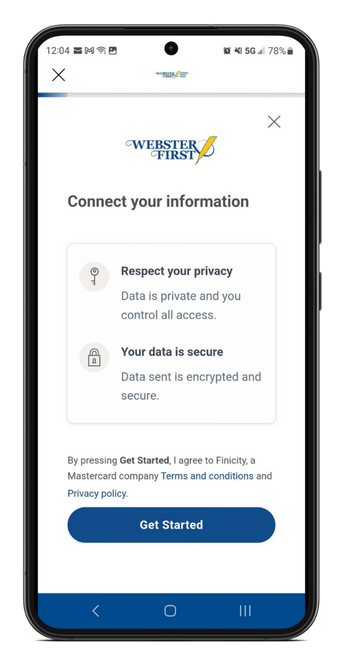

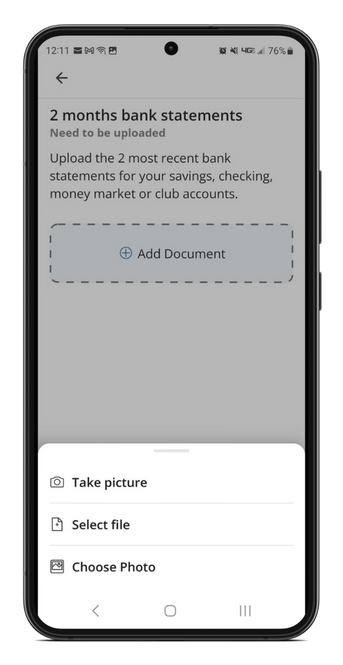

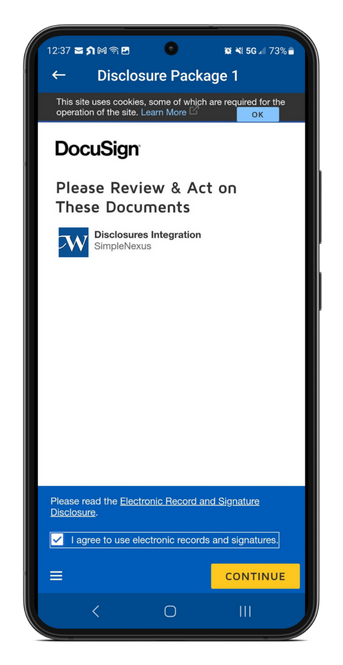

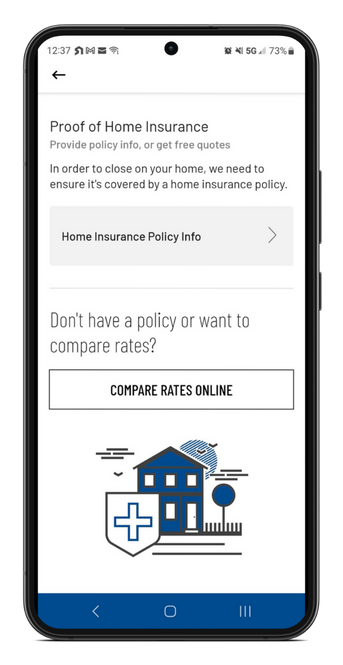

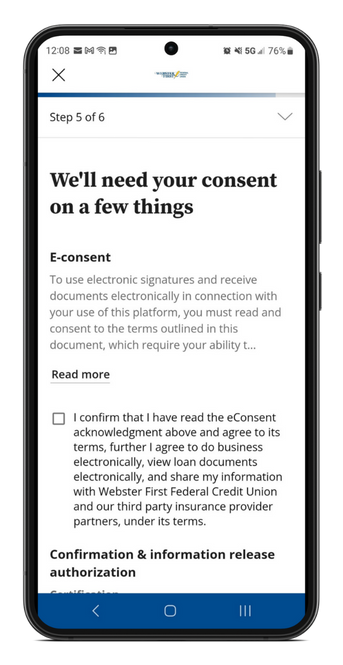

Our mortgage app makes it easy

Looking to buy or refinance a home? Our digital mortgage app makes it easy and convenient.

With one login, you can apply for a loan, complete tasks, securely scan and upload docs, submit payments, check on your loan status, eSign documents, and more. When you start an application online, you’ll find links to download the app to your favorite device.

How can we help?

Our dedicated loan center team is happy to answer your construction loan-related questions or provide assistance with completing an online construction loan application.

(774) 823-1665

Monday – Wednesday: 8:00 a.m. – 4:30 p.m.

Thursday & Friday: 8:00 a.m. – 5:00 p.m.

Saturday & Sunday: Closed