Land Loans

At Webster First, we understand the importance of financing decisions. You’re purchasing much more than a plot of land. It’s where you’ll build your home. Where memories are made.

Purchase your land now, worry about the build later. Our loan experts are here to help guide you from application to closing. When you’re ready, we’ll help with your construction loan too.

Apply NowLand loan program details

Home lending rates

| Type | Rate | APR1 | EMP2 (per $1,000) |

|---|---|---|---|

| Adjustable Rate Mortgages4 | |||

| 5&1 Fixed Variable4 | 5.625% | 5.725% | $5.76 |

| 7&1 Fixed Variable4 | 5.875% | 5.978% | $5.92 |

| 7&3 Fixed Variable4 | 6.000% | 6.104% | $6.00 |

| 10&5 Fixed Variable4 | 6.125% | 6.230% | $6.08 |

| Convertible 1 Yr Adjustable4 | 5.375% | 5.473% | $5.60 |

| 1 Year Adjustable4 | 5.375% | 5.473% | $5.60 |

| 3 Year Adjustable4 | 5.500% | 5.599% | $5.68 |

| 7&1 Variable 40 Year4 | 6.375% | 6.467% | $5.77 |

| Land Loan3,4 | 5.375% | 5.598% | $10.79 |

| Fixed Rate Mortgages | |||

| 15 Year | 6.000% | 6.174% | $8.44 |

| 20 Year | 6.500% | 6.644% | $7.46 |

| 30 Year | 6.875% | 6.988% | $6.57 |

| 40 Year | 7.125% | 7.226% | $6.31 |

| First Time Homebuyers | 6.500% | 6.570% | $6.32 |

2:EMP = Estimated Monthly Payment.

3:Land loans 1-10 years, 25% downpayment

4:ARM loans are variable rate loans, interest rates and payments may increase after consummation. Rates and payments will remain the same for the first 5, 7, or 10 years and then can adjust to a new rate and payment every 1, 3 or 5 years based on a current index, depending on the ARM program you choose. For example, if you select the 5 & 1 Fixed Variable program your rate and principal & interest payment will be fixed for the first 5 years (the 5 in 5& 1), after that the interest rate and payment could change every 1 year for the remainder of the mortgage’s term (the 1 in the 5 & 1).

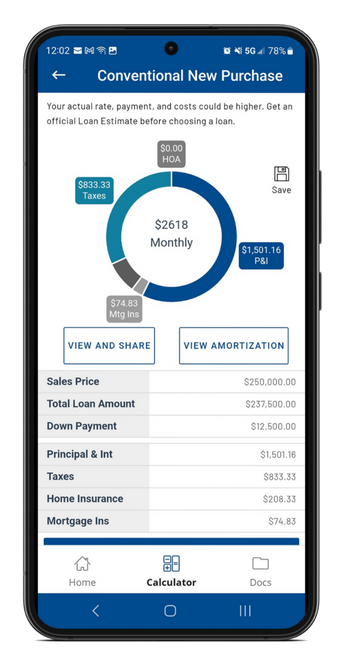

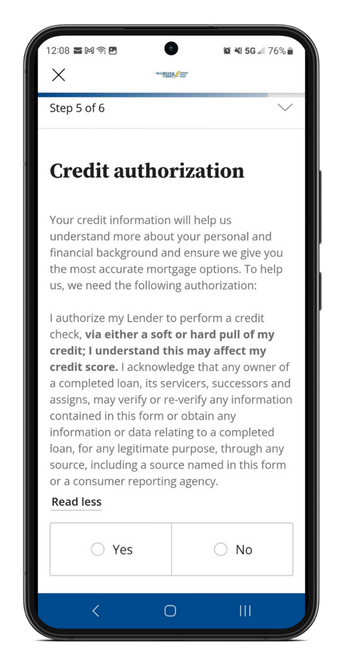

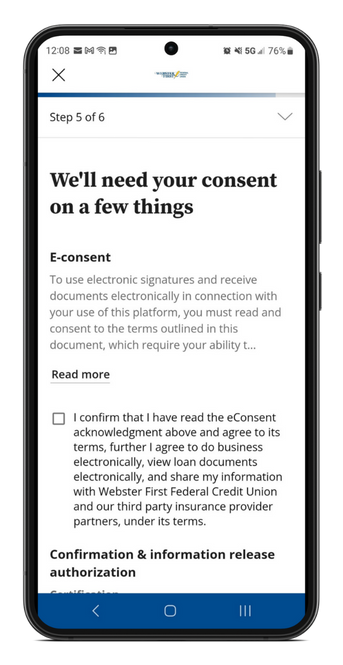

Our mortgage app makes it easy

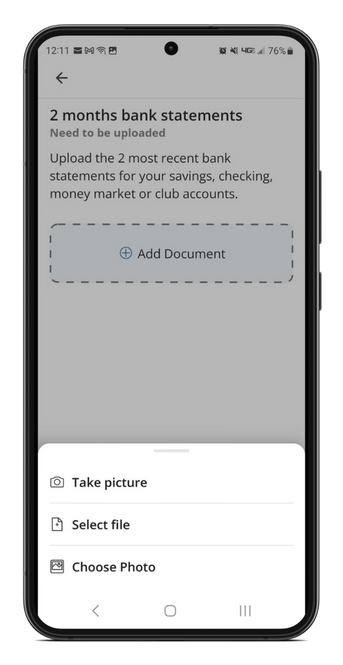

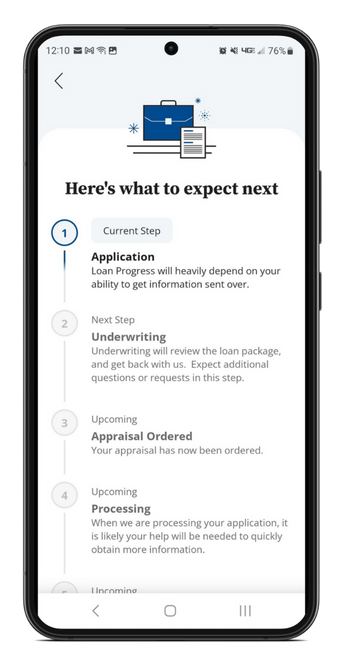

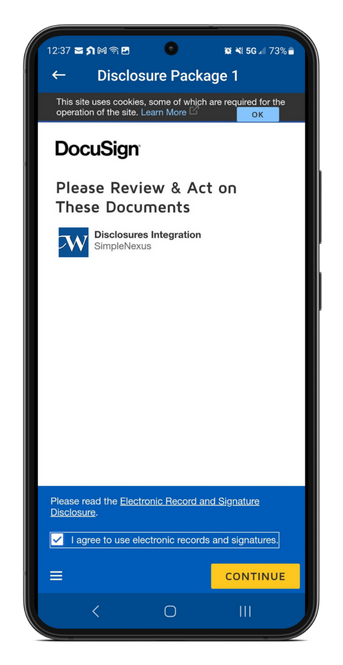

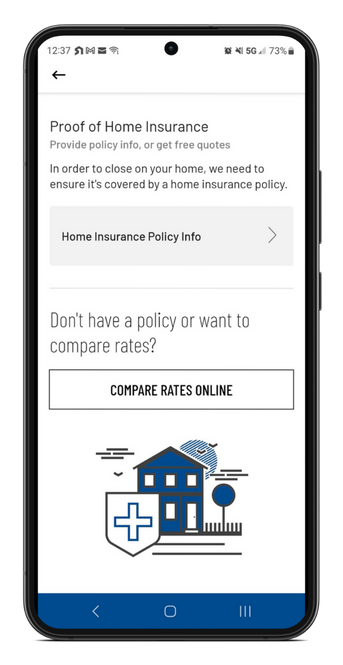

Looking to buy or refinance a home? Our digital mortgage app makes it easy and convenient.

With one login, you can apply for a loan, complete tasks, securely scan and upload docs, submit payments, check on your loan status, eSign documents, and more. When you start an application online, you’ll find links to download the app to your favorite device.

How can we help?

Our dedicated loan center team is happy to answer your land loan-related questions or provide assistance with completing an online land loan application.

(774) 823-1665

Monday – Wednesday: 8:00 a.m. – 4:30 p.m.

Thursday & Friday: 8:00 a.m. – 5:00 p.m.

Saturday & Sunday: Closed