Escrow account defined

When you take out a mortgage, a portion of your monthly payment may be collected and set aside for payment of real estate taxes and, in some instances, homeowners, flood insurance, and PMI. This is dependent on loan to value ratios, the loan product, and a determination as to whether your home lies within a flood zone. That portion of your payment is applied to an escrow account where it stays until it needs to be paid out.

How is escrow payment determined?

Your estimated taxes for the year are calculated at closing and we divide that by 12 to figure out what you should be paying monthly. If homeowners or flood insurance is included in your payment, we will divide the premium amount indicated on your insurance binders by 12 to determine that portion of your payment. You may see these amounts on statements listed as T&I. Your taxes and insurance payments are disbursed by the mortgage servicing clerk when they are due.

We also require a one month “cushion” in the event that there are extra costs which need to be covered. If your property taxes or insurance premiums are raised and there are not enough funds in your escrow account to cover the payment, we will still make the payment for you, but your escrow account will drop to a negative balance. We add the cushion as a buffer to try to avoid that.

Escrow payment example:

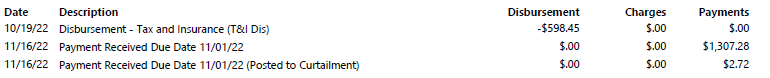

Here is an example of what an escrow payout would look like on page two of your statement, listed as T&I Disbursement:

Escrow Analysis

Each year in June we conduct an escrow analysis on all mortgages. We do this in June because the fiscal year used for accounting by the towns and cities of Massachusetts is July 1 through June 30, rather than January 1 to December 31. With this analysis we calculate an estimate of all your escrow payments for the next year, based on your payouts from the prior year. If your town has raised taxes or your insurance premiums were raised, it could mean that our analysis will show you ending on a negative balance.

Escrow Deficiency

Your escrow analysis could have both a negative balance and a shortage. This might happen if your escrow account balance was already negative when we calculated the payments, and the projections showed you ending with a shortage. If the projected payments for the new year show a shortage, you will have to recoup those costs one of two ways.

- The negative balance and/or shortage will be split up over the next 12 months (starting with your August 1 payment) and be included in your payments, meaning you will have a higher payment amount. This will happen automatically unless you choose option number 2.

- One upfront payment of the total negative balance and/or shortage, due no later than July 15. Call our mortgage servicing department at (800) 962-4452 Ext 4094 and ask them for the exact amount you will need to cover your escrow deficiency. You can either have the mortgage servicer transfer it from a Webster First account, mail it in a check, or you can bring the funds to a branch. When you make the payment in branch, let the teller know to call Mortgage Servicing and tell them you are paying the escrow deficiency so it can be applied as such.

Note: Regardless of if you pay for the deficiency, if your taxes or insurance have gone up, you will see an increase in your escrow payment, as it is still 1/12 of the yearly amount.

If mailing a check, write on the memo line, “Escrow deficiency for [account #].” Mail checks to:

Webster First Federal Credit Union

Attn: Mortgage Servicing

271 Greenwood Street

Worcester, MA 01607

Escrow Surplus

If your escrow analysis shows that you have a surplus greater than $50 in your account, we are required by law to return that surplus to you in a check within 30 days. That law is Regulation X.