How to achieve your financial New Year’s resolutions

Updated December 19, 2024 | Published January 1, 2023 by Angela Talbot

-

Categories:

- Debt & Your Credit

- Saving & Budgeting

- Spending & Shopping

As we ring in 2024, we begin another year of working toward financial freedom. A recent survey by The Ascent shows that two-thirds of respondents plan to make a financial new year’s resolutions, with paying off debt being the top resolution. Whether it’s the new year or not, working on improving your financial health is always a great goal.

Financial New Year’s resolutions in 2024

In 2024, inflation dropped and interest rates lowered slightly. But that doesn’t mean that consumers didn’t still take a hit to their wallets. Prices of goods remain high, and the housing market remains unchanged. As a result, there is less money in people’s accounts and higher balance on their credit cards. In fact, credit card debt is at an all time high. Are you planning to pay off some debt in the new year, or do you have bigger goals like saving up to purchase a home? Webster First can guide you to achieving your goals with these helpful steps.

Budget better

Do you know how much money you’re spending each month? How much goes to groceries? What about gas, utility bills, or other necessities? How much are you spending on nonessential items?

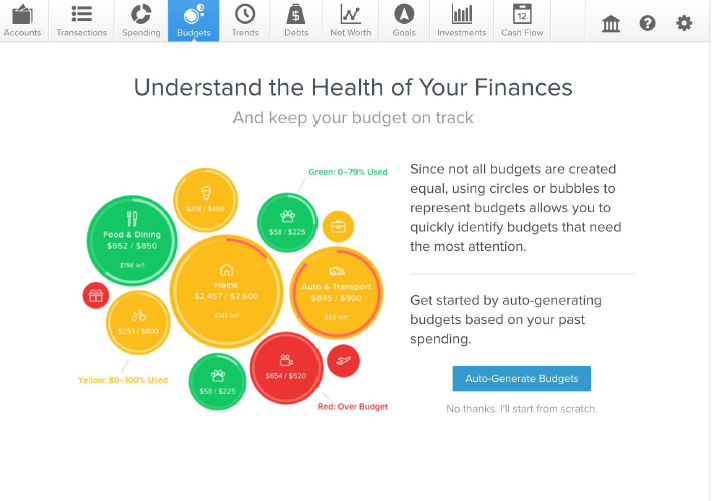

The first step to budgeting is figuring out where your money goes. Keep track of your spending month to month, or even week to week. After you have a few weeks of records, take a look. You’ll start to see where your money goes, and can begin to think about how to better manage it. Maybe you’re spending too much on takeout dinners and can reduce spending by getting meals at the grocery store. You can keep track of your spending manually, or take advantage of our Money Management tool which categorizes each transaction. Our article New year’s budgeting made easy offers a step-by-step walkthrough to set up your budget in Money Management.

Manage your debt

Paying off or paying down debt is often a stepping stone to achieving larger goals. Perhaps you have a goal of buying a home or a new car in 2025. Maybe you want to boost your credit score by paying a credit card to $0. Whatever your goal is, paying down debt will likely help you reach it.

Debt payoff strategies

There are a few different strategies you could try to shorten your payoff time.

- Debt snowball strategy: With this strategy, you focus on paying off your accounts starting with the lowest balance first. Meanwhile, you make only the minimum payment on accounts with higher balances. Once the small debts are gone, you add what you would have been paying on those bills into your payments on the larger accounts.

- Debt avalanche strategy: The debt avalanche strategy takes the approach of paying off your debts with the highest interest rate first, while making the minimum payments on the rest. Once you pay off the highest rate, you move to the next highest rate account, and so on.

- Debt consolidation: Consolidating your debt means taking multiple loans and combining them into one so you only have to make one monthly payment instead of several. The consolidation loan will most often have a lower rate than your original loans. You could do this with a personal loan or a home equity loan. Talk to one of our loan officers to see which choice would be best for you.

All three of these strategies can work to help you get rid of debt faster. If you’re wondering exactly how long it will take you to pay off your debt, use our calculators to answer questions like, “Should I refinance?” “How long will it take to pay off my credit card?” “Should I consolidate my loans?” and many more. The Debts tool within Money Management can also forecast your payoff timeline once you’ve come up with your strategy. For more tips, check out How to pay off debt faster.

Review your existing bills

We’ve talked about how you can save money on your debt, now let’s talk about saving money on the rest of your bills. By that we mean your utility bills, phone plans, car insurance, etc. Review all your plans and shop around for quotes to see if you can find these services cheaper somewhere else. What you’re paying for a phone plan at one carrier may cost less to get through another carrier. Or there may be a more affordable plan through your current carrier that you weren’t aware of. Many phone companies even offer to throw in a free or discounted streaming service subscription if you switch plans with them, which can save you even more if it’s a service you currently pay for. Don’t forget to eliminate subscription services that you aren’t using. If you’re looking to lower necessary bills like home energy bills, follow the tips at this link.

Refinancing

Refinancing a mortgage or loan could help lower your overall monthly payment or save you on interest payments over time. It could even help you pay of the loan faster if you shorten your term. Speak with a loan officer to see if refinancing makes sense for you.

Switching Insurance

When reviewing your car or homeowners insurance, talk with an insurance agent as it is their job to find the best possible deal for you. Our subsidiary, WebFirst Insurance, LLC, works with a variety of carriers and can search their network to get you the right coverage at the right price, saving you time and money.

Start planning

Whether you have a New Year’s resolution of saving for retirement, starting a college savings for your child, or setting aside money for a down payment, taking these steps to plan your finances for the coming year will help get you the extra money necessary to achieve your goals. And if you still need help, Webster First’s excellent team will be there to provide the award-winning service that our members stand by.