Mortgage and Home Equity FAQs

Do you offer mortgage refinancing?

Yes, Webster First offers refinancing of Mortgages, Home Equity Loans, and Home Equity Lines of Credit.

How do I apply?

You can easily apply online.

Can I get pre-approved or pre-qualified?

Webster First only does pre-approvals. Unlike pre-qualifications, a pre-approval requires a full underwrite and credit pull. You are not locked into an interest rate until we receive a property address.

What documents will I need with my application?

While this varies depending on your situation, our team has put together a list of the standard documents for easy reference. Please note that additional documentation may be requested depending on your financial situation.

Do you offer VA or FHA loans?

Not at this time.

What are your application fees?

Application fees are $400 for a mortgage and $650 for a construction loan. Home Equity Loans and Lines of Credit have $0 application fees.

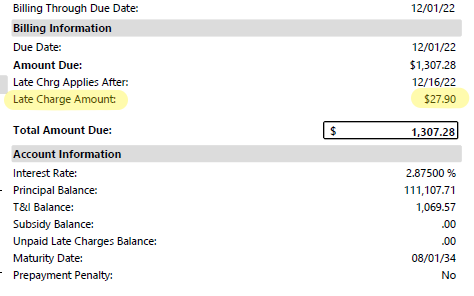

What is your fee for a late mortgage payment?

Late fees will vary based on your total mortgage payment. See your statement billing information. For example:

What is the difference between a fixed rate and an adjustable rate4?

A fixed rate mortgage will have the same interest rate for your entire term. Adjustable rate mortgages4 will change periodically based on the term you choose. Some adjustable rate mortgages are fixed variables meaning they are fixed for a certain amount of years, and adjusted after that period ends. For example: our most popular type of adjustable rate mortgage (ARM) is our 7&1 fixed variable, which means the rate is fixed for the first seven years and then changes once a year for every year after that. See our rates page for more terms.

Do you offer land loans?

Yes. Webster First land loans are only available as adjustable rate4 loans from 1-10 year terms and require a 25% down payment. See our land loan page for more info.

How do Construction Loan disbursements work?

Construction funds are only disbursed for completed items. We will need the following items prior to your first disbursement being released.

- Proof of Insurance/Builders Risk Policy

- Building Permit

- Proposed Plot Plan

Inspections will be ordered by you, the borrower, through the Mortgage Servicing Department, available by:

- Phone – 800-962-4452 ext. 4094

- Email – MortgageServicing@WebsterFirst.com

- Fax – 774-823-1842

Once an Inspection has been requested, please allow a reasonable amount of time for the property to be inspected and the report completed, then returned to Webster First Federal Credit Union for approval. Once the report is approved, allow 1-2 business days for the funds to be disbursed.

Options for how funds can be disbursed:

- Deposited directly into the borrowers Webster First Federal Credit Union account

- Bank check made payable to the borrower(s)

- Bank check made payable to borrower(s) and the builder or contractor

What do I do in the event of a borrower’s death?

Contact our Mortgage Servicing department at (800) 962-4452 Ext. 4094 and forward them the death certificate for the mortgage file. If there is a co-signer on the mortgage, they will still be obligated to make payments on the loan. Next steps will vary based on what the deceased had planned to pay off the remaining balance on their mortgage (terms in their will, a trust, life insurance policy, etc.). If there were no plans, the credit union may foreclose on the property.

If there was no co-signer, another person can request to be granted successor in interest which allows them to access certain mortgage information/documentation such as a payoff quote. Based on the circumstances, we will request specific documentation to approve a successor in interest request.

I received a check for an insurance claim on my house with Webster First’s name on it. What do I do now?

If you have a lien on your house and an insurance company pays you for damages (such as a fire, tree falling on it, etc.) the check will be made out to both you and the lien holder (Webster First). Our Mortgage Servicing department will be able to help you disburse the funds from the check, but portions of those funds may be held and released to you later. Contact them at (800) 962-4452 Ext. 4094.

What is Home Equity?

Simply stated, home equity is what your home is worth, minus anything you owe. In other words: Equity = Home Value – Liens.

Say you’ve taken out a 30-year mortgage for $280,000 on a home that is valued at $350,000. You’ve been making payments for 10 years, and the remaining balance of your loan is now $145,000. The difference between the current market value of the home and what you have left to pay is the amount of equity you have. In this case, it’s $205,000. This amount can vary based on what your home is worth at the time of calculation. The larger the down payment, the more equity you have on your home immediately. Because the borrowers in this example made a 20% down payment, they started with $70,000 in equity right away.

Is a home equity loan or line of credit better for me?

Many people use these to make improvements on their home, but they can also be used for various other reasons. See Home Equity Loans vs. Home Equity Lines of Credit for help with choosing which one is right for you. At Webster First, we will pay all of your standard closing costs for you. However, if you refinance or payoff a HELOC before having it open for two years, you will need to pay the closing costs.

Home Equity Loans have a fixed rate for their entire term, while HELOCs are fixed for the first two years, and adjusted to prime rate thereafter.

How does the draw period on my HELOC work?

HELOCs (less than 80% Loan-to-value) have a 40 year term: 20 year draw period and 20 year repayment period.

Max Home Equity Lines of Credit (over 80-100% Loan-to-value) have a 20 year term: 10 year draw period and 10 year repayment period.

How am I billed?

Home Equity Loan and HELOC bills are cut on the 16th of the month with a due date of the 15th on the following month. There are no late fees on these loans, however, you will still be reported to the credit bureaus as late after 30 days have gone by.

Note: If you make a HELOC payment on the 16th or later, the payment will satisfy the interest for both months first, then any remaining balance will be applied to principal.

What is a Finance Charge?

You will see the term “Finance Charge” on HELOC bills. This is just another way of saying interest. The monetary amount you see under Finance Charge is the amount the credit union charges you for the loan.

How do I pay down or pay off my Home Equity?

Contact the Mortgage Servicing department at (800) 962-4452 Ext 4094 or mortgageservicing@websterfirst.com to receive a quote (or have your attorney do it). Payment can then be applied by mailing in a check, transferring the balance from another account, or dropping off the funds in branch. If you are transferring funds from another account, have the mortgage servicer apply the payment to ensure it is done correctly.

Once you have received a quote for a HELOC, it is important that you do not draw funds from it until your pay down, payoff, or refinance is complete, as this will change the numbers on the quote.

What’s the difference between a paying down and paying off?

Because a HELOC is a revolving line, paying it down means paying the balance down to $0 but leaving the line open for you to draw off of in the future. Paying off a HELOC means that your line will be closed and discharged at the registry of deeds, and no additional funds can be drawn from it. When you receive your quote for a payoff it will have a discharge fee included, while a quote for a pay down will not.

Additionally, a payoff quote for a HELOC that has been open for less than two years will have your closing costs included in the fee section. A pay down would not.

Fixed Home Equity loans cannot be paid down. All available funds are disbursed to you immediately in the form of a deposit, and you pay back the funds for your selected term (up to 15 years).

How do I increase my HELOC limit?

The only way to increase the limit of your HELOC is to refinance into a new one. Talk with one of our licensed loan officers to do this.

What is a Max Equity?

Max Equities are any Home Equity Loan or LOC with an LTV (Loan-to-Value) ratio of over 80%. This can happen when the value of the house doesn’t come in high enough on the appraisal. These loans have a 10-year draw period and 10-year payback period regardless of the state the property is in. They will have a higher interest rate and PMI, but the credit union will pay PMI for you on an equity just as it pays the closing costs.