Find the business checking account that’s right for you

At Webster First Federal Credit Union, we know your business deserves more than a one-size-fits-all solution. That’s why we offer two tailored business checking accounts to fit your unique needs. Whether you’re just starting as a sole proprietor or leading a growing LLC, our accounts provide flexibility, security, and convenience—with no hidden fees.

Apply for First Advantage Checking for Business In-Branch Get Started With Elite Business CheckingWhich Business Checking Account Is Right for You?

| First Advantage Checking for Business | Elite Business Checking | |

|---|---|---|

| Useful for | For sole proprietors with few to no employees or DBAs | Small to Mid-Size Business Checking: LLCs, LLPs, Corporations, and Partnerships |

| Rate | .01 | Tieres: See all rates |

| Minimum Opening Deposit | $5.00 | $5.00 |

| Monthly Maintenance Fees | $0.00 | $0.00 |

| Business Debit Card | Yes | Yes |

| Cash Management Suite | No | Optional for $25 monthly fee. Recommended for businesses with 25+ employees. |

| Remote deposit | Free | Free |

| Monthly deposit limit | None | None |

| Overdraft protection | Yes | Yes |

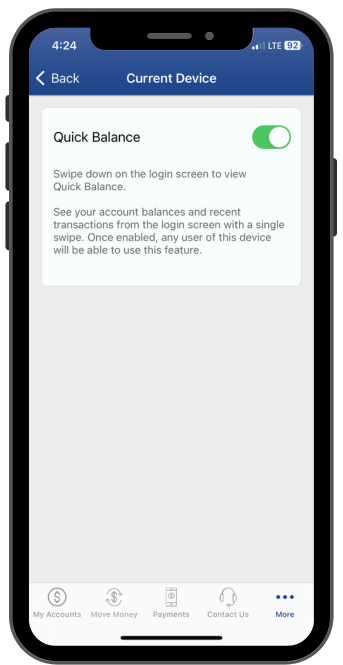

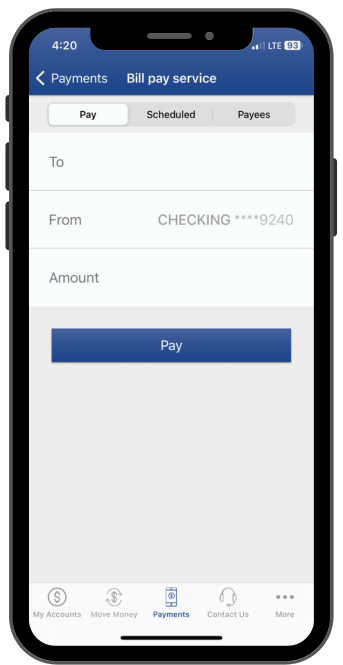

Convenient access to your business accounts, anytime

Online banking and our mobile app make taking care of business easy.

Learn MoreAward-winning service

Business Debit Mastercard®

Enhance your business spending with the Webster First Business Debit Mastercard®—powered by Mastercard and built with your security in mind.

Earn cash back‡ on qualified purchases with our free program:

- Shop offers right from online banking or our app.

- Shop based on the offer terms using your Webster First Mastercard® debit card or connected mobile wallet.

- Earn your cash reward! Rewards are deposited right into your account.

Plus, you can earn rebates with the Mastercard Easy Savings® program30.

FAQs

What are the requirements to open?

First Advantage Checking for Business:

- Business must be a DBA or Sole Proprietor.

- One of the following must apply:

- The business owner is a current Webster First member.

- The business owner lives, works, worships, or attends school in Worcester, Essex, Middlesex, or Suffolk County, MA.

- $5 minimum balance.

Elite Business Checking:

- Business must be a Corporation, LLC, LLP, or Partnership.

- Business must meet Webster First membership qualifications:

- Persons or legal entities must be located in Worcester, Essex, Middlesex, or Suffolk Counties, MA; and also included are spouses of persons who died while within the field of membership of this credit union, employees of the credit union, volunteers in the community, members of their immediate family or household, and organizations of such persons.

- $5 minimum balance.

What documents will I need?

For First Advantage Checking for Business:

- Driver’s License

- Social Security Number

- DBA-specific:

-

- Business certificate from the town where your business is located.

- Sole Proprietor-specific:

-

- Tax ID paperwork from the IRS.

For Elite Business Checking:

- Driver’s License

- Social Security Number

- At least one of the following:

- Articles of Incorporation

- Articles of Organization

- Partnership Agreement

- Limited Partnership Document.

- At least one of the following:

- SS4 Tax ID form or most recent federal tax return.

- Certification of Beneficial Ownership.

Additional documentation might be required depending on your business type.

Apply for your business checking account today

Your business deserves an account that works as hard as you do. Start right now by finding a Webster First branch near you, and take the first step towards easier, more secure business banking.

Additional services you may like:

Process credit and debit payments from customers in retail locations, on mobile, or online.